Market Focus

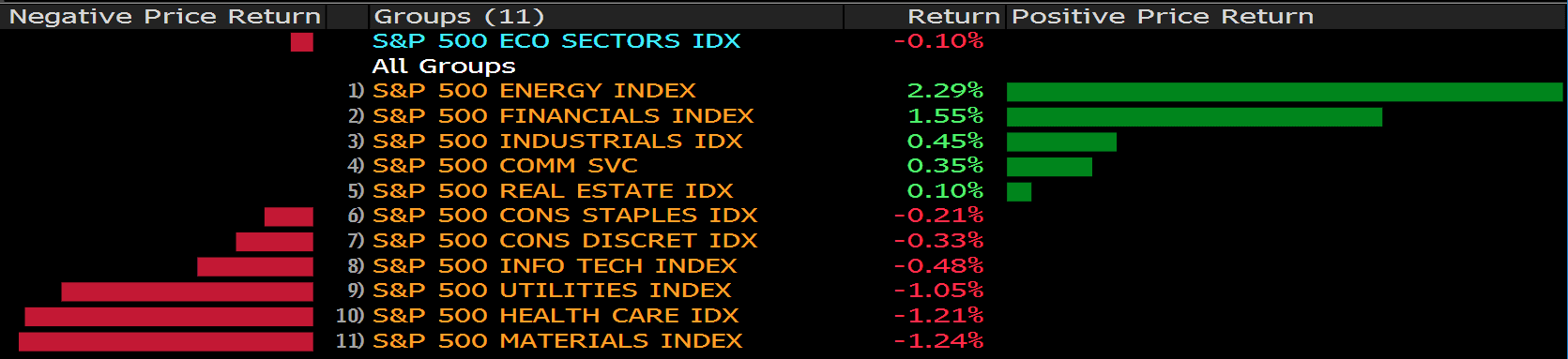

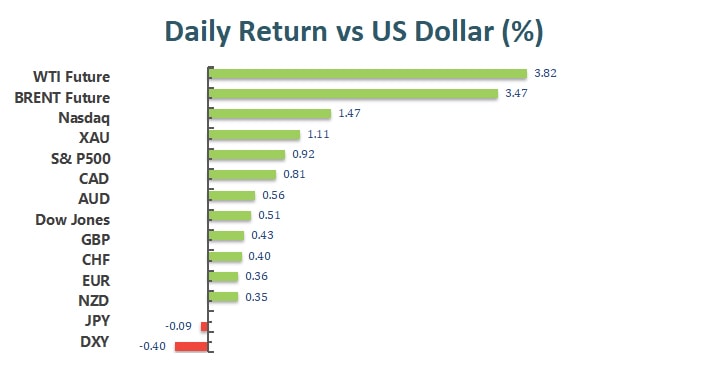

The broad U.S. equity market rebounded last night as Federal Reserve chairman Jerome Powell smoothed tightening fears across markets. The Dow Jones Industrial Average gained 0.51% to close at 36252.02, the S&P 500 gained 0.92% to close at 4713.07, and the Nasdaq composite gained 1.41% to close at 15153.45. The benchmark U.S. 10 year treasury yield lowered slightly to 1.746%, while the 30 year treasury yield also slid to 2.076%.

The energy sector gained an impressive 3.41% over the course of yesterday’s trading. Oil prices has risen from its year end low and is currently trading at $81.343/ bbl. Market participants have reassessed the Omircron variant’s impact on travel. APA Corp., and Occidental Petroleum Corp. both enjoyed more that 7% gains.

Main Pairs Movement:

Federal Reserve Jerome Powell’s testimony on Tuesday proved to be soothing for equity trader, but the rather mild tone by chairman Powell brought across the board weakness to the Greenback. The Dollar Index lost 0.36% over the course of yesterday’s trading.

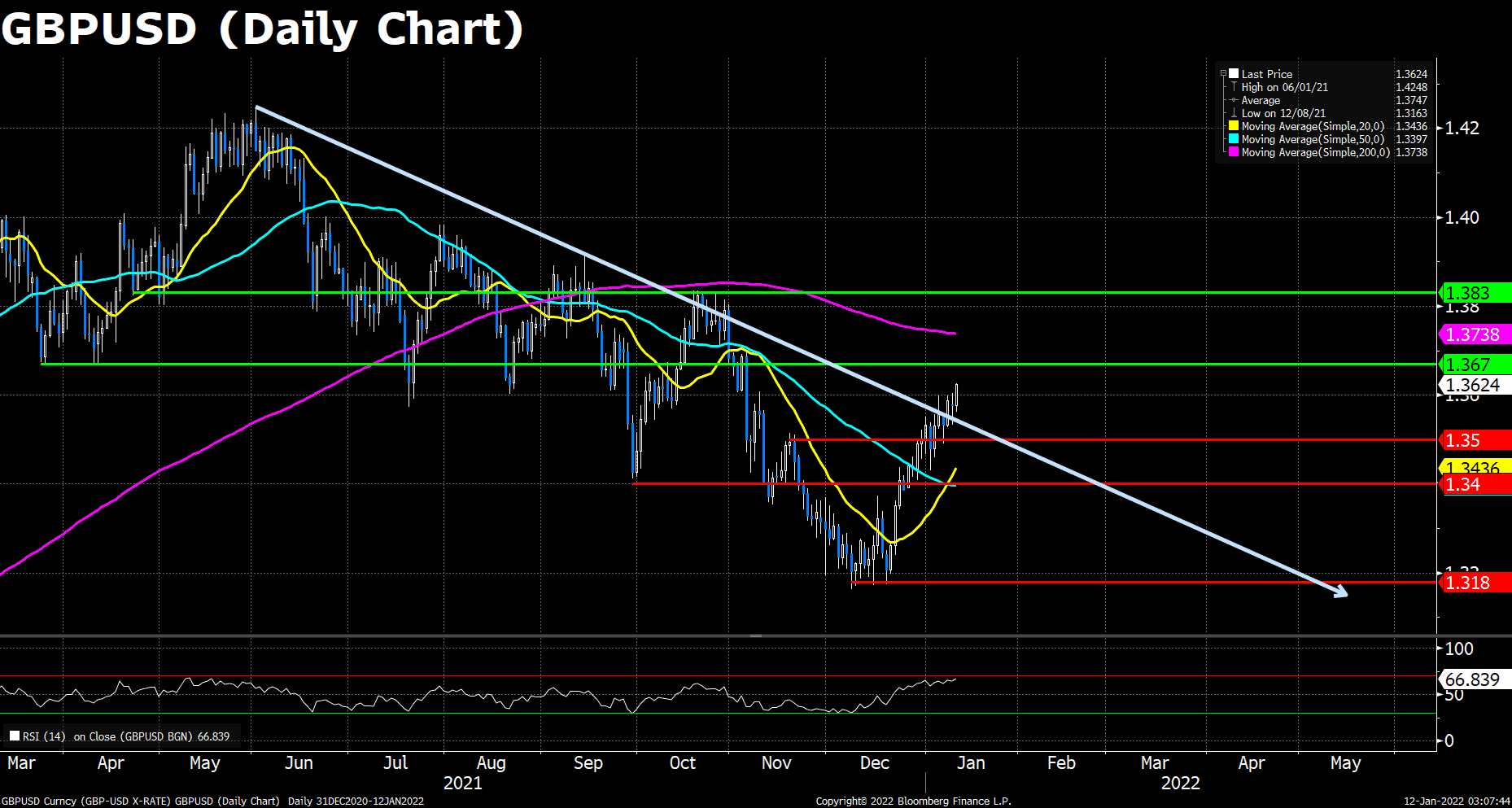

Cable gained amid a weaker Dollar. Tonight’s U.S. CPI data could fuel the Sterling’s recent upward momentum.

The Euro-Dollar pair gained 0.36% over the course of yesterday’s trading. Most of the upward price action came after the U.S. equity markets opened and is continuing to rise over the early sessions of Wednesday.

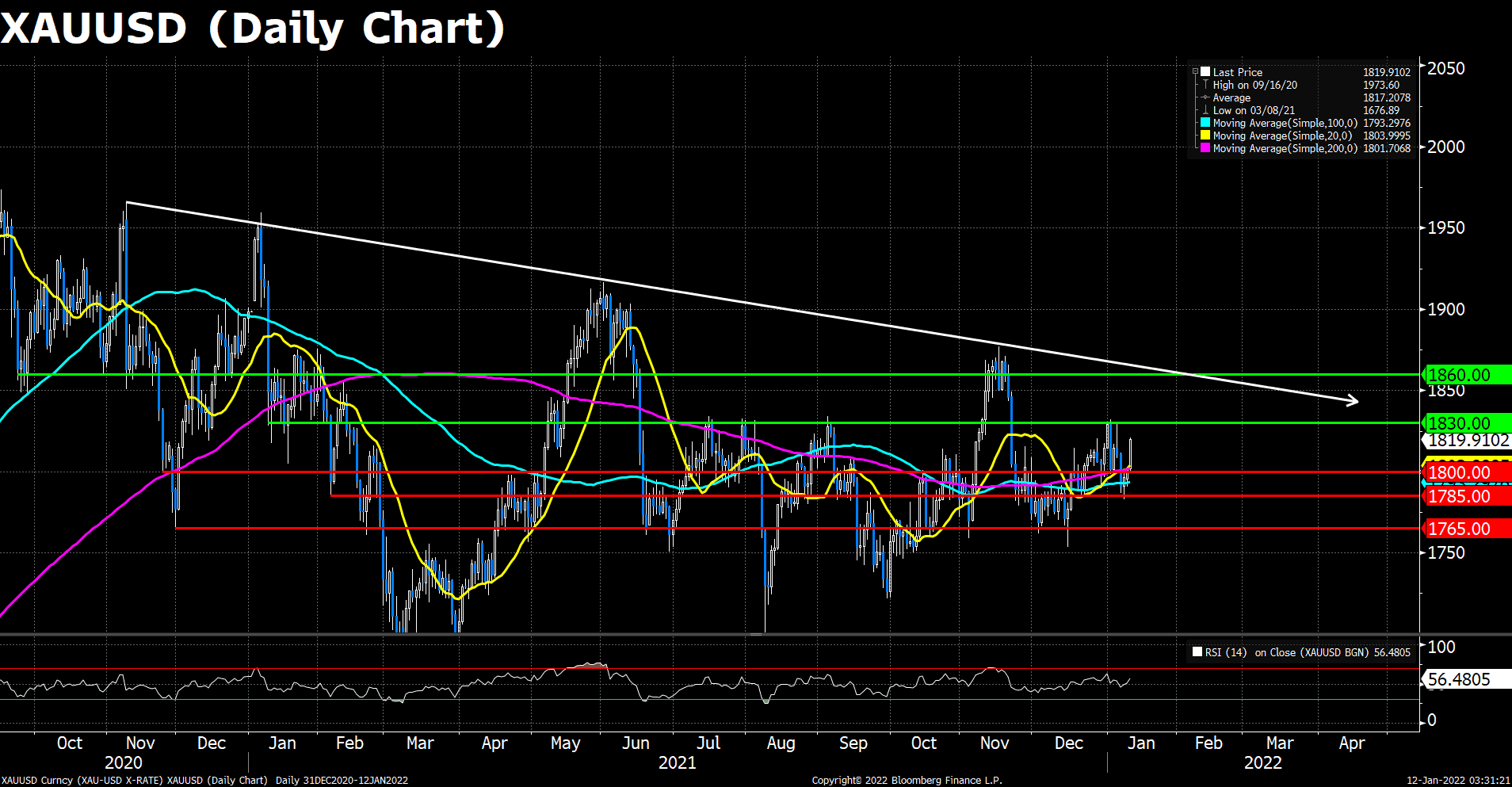

Gold gained an impressive 1.1% over the course of yesterday’s trading. The precious metal is continuing its 3 days win streak, but the U.S. CPI data could bring substantial volatility to Gold.

Technical Analysis:

Cable gradually climbed up from Monday’s dip in the Asian and European trading hours amid the global equity markets’ rebound. The pair now trades at around 1.3620, firmly above the past strong 1.3600 resistance. Fed Chair Jerome Powell went to his nomination hearing earlier the day, and fortunately he didn’t mention any new tightening policies or plans during the testimony, which eases the appreciation pressure of the dollar, and thus benefits the non-US currencies, including GBP.

On the technical front, GBP/USD jumped further away the past downtrend line and over the critical 1.3600 level. The RSI indicator is around 67, and the price action is above its 20 and 50 DMA, suggesting a sturdy bullish traction pulling the pair to the north.

Resistance: 1.3670, 1.3830

Support: 1.3500, 1.3400, 1.3180

The shared currency price consolidated during the first half of the day, and surged after the Wall Street opening, especially during the Powell’s hearing, as no new policies or plans were announced, and Fed’s confidence toward the US economic outlook relieves the market’s worries about additional tightenings in the coming month. However, the dovish stance of the ECB keeps weighing on Euro. An ECB executive board member Isabel Schnabel said in her Saturday speech that only in circumstances that the current surging energy prices transmitted to other economic fields, or the green transition policies severely jacked up the energy prices, will ECB consider to take actions to ease the inflation.

On the technical, though the Euro pair advanced quite a bit (0.41%) during today’s tradings, it is still under its 200 DMA, and hasn’t cross over the critical 1.1400 resistance line. The RSI indicator remains around the average line, providing almost no instructions about the future route of the pair. As previously mentioned, the pair must stand firmly above the key 1.1400 resistance to claim a meaningful rebound. On the flip side, a slip below the 1.1200 support may indicate the resuming of the selling streak.

Resistance: 1.1400, 1.1620, 1.1700

Support: 1.1200, 1.1000, 1.0780

Gold went up in the third consecutive day amid the weakness of the dollar, as the Fed Chair Powell didn’t pull out new tightening policies during today’s testimony, which eases the public concerns about a potential fourth rate hike at the end of the year warned by Goldman Sach analysts. The yellow metal now trades at $1,818 per troy ounce, heading to the key $1,830 resistance where it got blocked for several times. The rally of the pair is expected to continue before the Fed takes further actions. That’s said, the current cautious market mood is in favor of the save-haven gold, but the looming rate hikes of the Fed acts as an obvious headwind limiting the upside of the pair.

As to technical, gold remains firmly above the $1,800 support during today’s trades. The recent dollar weakness as well as the cautious market mood help gold price to cross over all its major moving averages and open a short-term winning streak. The RSI for gold reads 56.21, suggesting a neutral-to-bullish sentiment in this spot. However, gold’s price action is still capped by the long term downtrend started in November 2020. A breach of that trend will need a breakthrough over the $1,860 resistance, which is almost impossible to achieve without significant catalyst. On the flip side, if the pair failed to cling on $1,800, a short-term support will appear at $1,785 and the next support level will be at $1,765 once it plummeted further.

Resistance: 1830, 1860

Support: 1800, 1785, 1765

Economic Data:

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

|

|

USD |

Core CPI (MoM) (Dec) |

21:30 |

0.5% |

|

|

USD |

Crude Oil Inventories |

23:30 |

-1.904 M |

|