Market Focus

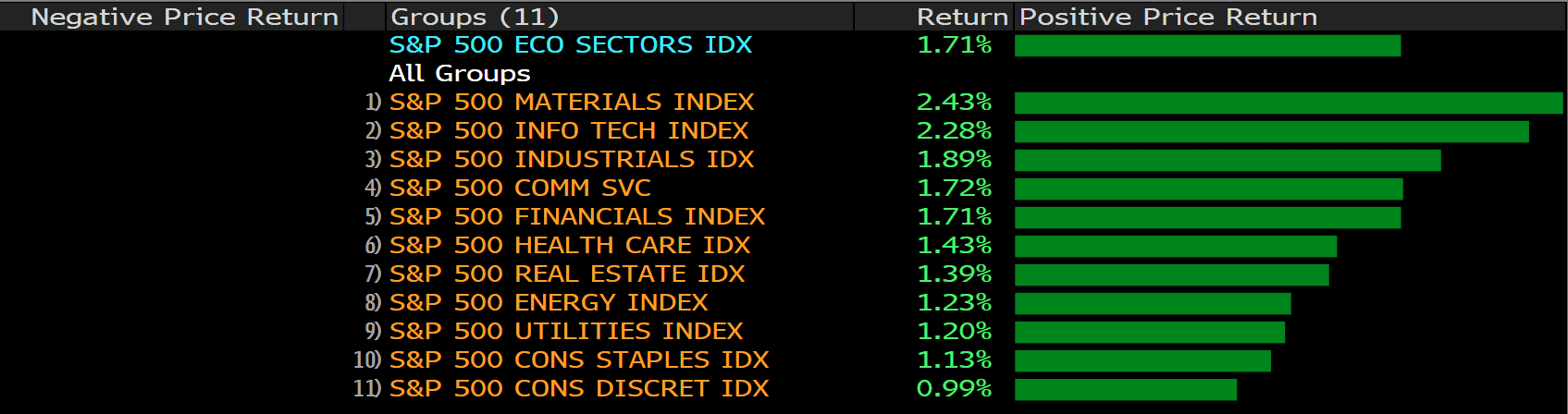

US stocks were mixed amid inflation concerns on Monday; investors bet on a continuation of strong earning reports from major companies while concerned the prospect of a tightening monetary policy to restrain inflation. The Dow Jones Industrial Average declined 0.1% while the S&P 500 climbed 0.3%; at the same time, the Nasdaq rose 0.8% at the end of day.

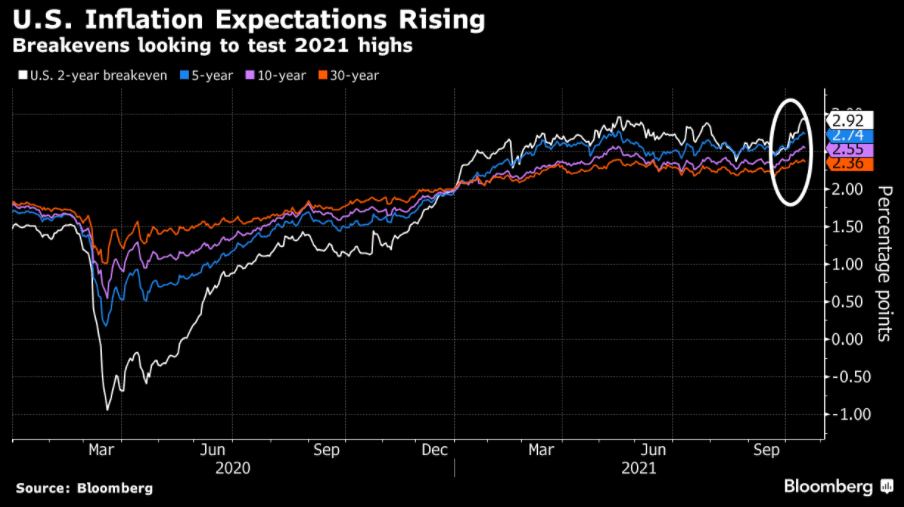

The collapsing spread between 5- year and 30-year yields is raising the concern of a potential slowdown in economic growth. The shrank might be due to the consideration of the US Federal Reserve may lift the rates sooner than the expectation. Moreover, according to Bloomberg, the US inflation expectations are continuously rising to their peaks in nearly years.

Bitcoin held steadily above $60,000 as the first Bitcoin future ETF is going to launch this Tuesday, which is essentially a milestone for the cryptocurrency industry.

Main Pairs Movement:

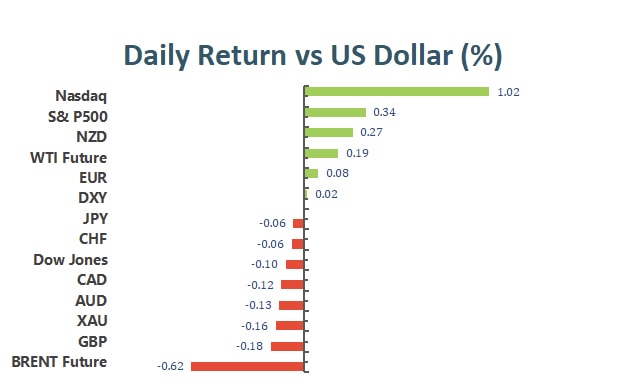

The greenback shed some ground on Monday, although it ended the day mixed across the FX board and within familiar levels. A light macroeconomic calendar keeps investors depending on the sentiment for direction, the latter following US government bond yields. Speaking of which, the yield on the 10-year US Treasury note peaked at 1.627% but finished the day at around 1.58%.

The dollar edged lower against most of its major rivals. The EUR/USD pair trades around 1.1610, while GBP/USD stands at 1.3730. The AUD/USD pair and USD/JPY finished the day unchanged while USD/CAD ticked lower, despite weakening crude oil prices.

Gold ended the day with modest losses at around $1,764.60 a troy ounce. rude oil prices hit fresh multi-year highs before retreating. WTI settled at $81.50 a barrel.

Attention shifts now to the UK inflation data, as the Bank of England has hinted at a possible rate hike as the first move in the case inflation keeps rising above the desired levels.

Technical Analysis:

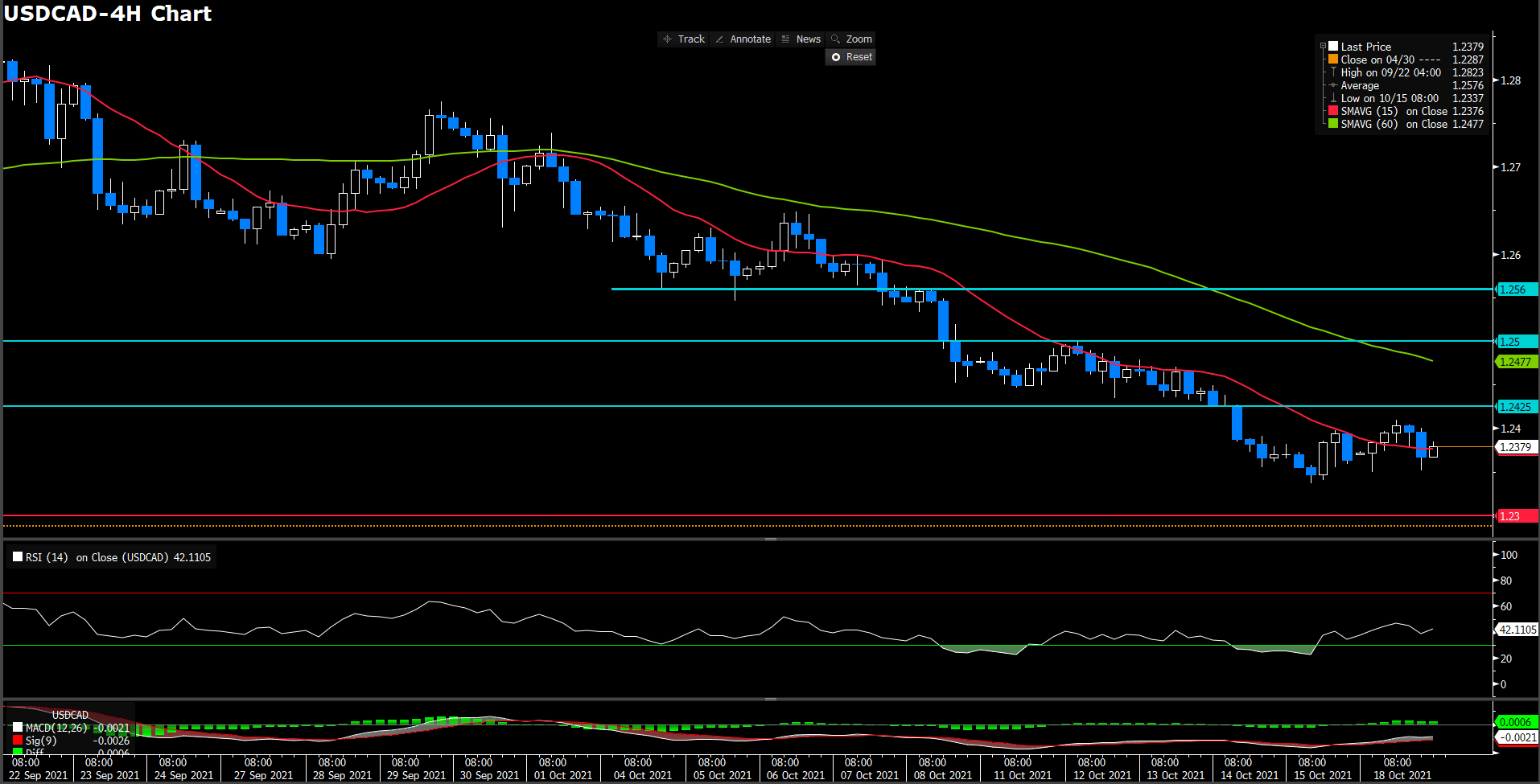

The USD/CAD pair continued consolidating through the first half of the European session and once stepped on the 1.2400 level, but soon fell over 30 pips after the American opening. Loonie’s weakness results from the higher inflationary pressures and the looming tapering of major central banks. The pair was last seen at 1.2375.

However, falling crude oil prices, along with the robust US bond yields, may weign on the appreciating CAD . WTI has been losing over 0.5%, currently trading at $81.90; the benchmark 10-year U.S. Treasury yield still lingers above 1.55, proving demands for the greenback.

On the technical front, loonie has already been lost track of its 4-month-old uptrend at the start of October and fallen below all of its key moving averages. The downward traction is now attacking the robust 38.2% Fibonacci support. If breached, then there will be no practical support ahead of the 23.6% Fibonacci. On the flip side, to resume its previous uptrend, the pair should revisit the key 200-DMA, which should first regain the 50% and 61.8% Fibonacci.

Resistance: 1.2425, 1.25, 1.256

Support: 1.23

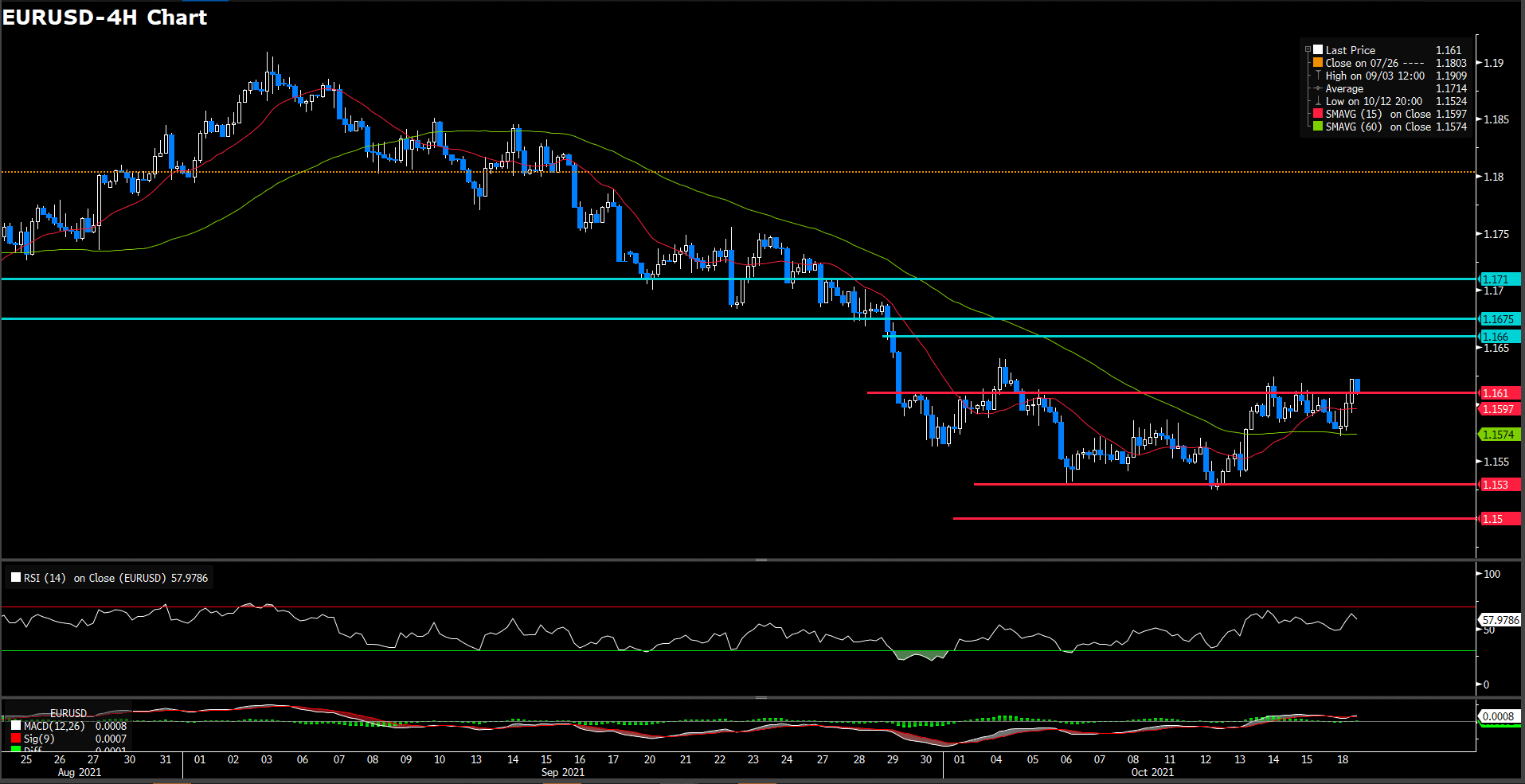

The euro advances during the New York session, up 0.07%, trading at 1.161 at the time of writing. During the session, market sentiment conditions improved despite a weaker than expected third-quarter GDP print out of China, rising inflationary pressures, and central bank tightening monetary conditions expectations. On last Saturday, October 16 ECB’s President Lagarde said that the ECB is paying very close attention to wafe negotiations and other effects that could permanently drive prices higher, she added that inflation is largely transitory.

On technical side, the RSI solely moved whereabout 57.97 figures, a slightly changed compare yesterday, suggesting a slightly bullish movement in short term. On moving average aspect, 15- and 60-long indicator are both moving flatly while they have been golden cross in earlier days.

In lights of current price has penetrated 1.161 level which we expected as a critical resistance for up traction before, it seems could continue the bullish movement if it could hold above the threshold. On up side, we expect the immediately resistance will be psychological level at 1.165 and 1.1675 following

Resistance: 1.165, 1.1675, 1.171

USDJPY (4 Hour Chart)

The Japan yen barely moved advances during the U.S. session, up some 0.02%, trading at 114.22 at the time of writing. Despite slower than expected economic growth in China, expectations of higher inflation and market mood is in risk-on mode. The U.S. 10-year Treasury yield is flat at press time, clings to 1.581%, whereas the U.S dollar index, which tracks the greenback’s performance against a basket of rivals, slides 0.02%, sitting at 93.943. Meanwhile, the yen is close to four-year lows versus the greenback, as higher U.S. T-bond yields which have been rising lately, have a strong positive correlation with the pair.

From a technical perspective, RSI indicator rebound reversed from over bought sentiment at 67.7, suggesting bullish momentum in short term. On moving average indicator, 15- and 60-long indicator still retaining upside traction.

Since yen stand above 114 level solidly for days, it seems lost driving momentum or further trigger foundamental news currently. Therefore, 114 level still a important support level for buy side investor.

Support: 114.02, 112.57, 112

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

AUD |

RBA Meeting Minutes |

09:30 |

– |

||||

|

GBP |

BoE Gov Bailey Speaks |

20:05 |

– |

||||

|

USD |

Building Permits (MoM)(Sep) |

20:30 |

1.680 M |

||||