In the penultimate trading session of the year, the S&P 500 approached an all-time high, indicating a robust finish to an exceptionally bullish year for stocks. The Dow Jones Industrial Average secured a new record, while the Nasdaq Composite saw a slight dip. With major indices poised to end 2023 on gains, projected around 13.8% for the Dow and 24.6% for the S&P, the Nasdaq’s remarkable 44.2% rise stands out, buoyed by tech giants and fervor over AI. As the market anticipates the traditional “Santa Claus rally,” the late 2023 surge sets an optimistic tone for 2024, backed by positive technical indicators and expectations of rate cuts and reduced inflation. In the currency market, the US Dollar Index fluctuated significantly, buoyed by rising Treasury yields, impacting major pairs like EUR/USD and GBP/USD. Additionally, USD/JPY and AUD/USD experienced noteworthy volatility, while gold faced a pullback amidst the USD resurgence and climbing yields, reflecting the complex interplay of economic factors and geopolitical events shaping currency movements.

Stock Market Updates

In the penultimate trading day of the year, the S&P 500 edged slightly higher, nearing an all-time high at 4,783.35, signaling a robust end to a bullish year for stocks. The Dow Jones Industrial Average also achieved a new record, closing at 37,710.10, while the Nasdaq Composite experienced a minor dip to 15,095.14. Notably, all major indices are set to conclude 2023 with gains, with the Dow and S&P projected to finish up nearly 13.8% and 24.6%, respectively. The Nasdaq stands out with a remarkable 44.2% climb, its most substantial increase since 2003, primarily fueled by the resurgence of mega-cap tech companies and the fervor surrounding artificial intelligence.

Amidst this year-end rally, the market looks forward to the “Santa Claus rally,” historically observed in the final days of a year and the early days of the subsequent one. The market’s impressive late-2023 surge, rebounding from a sluggish third quarter, positions the S&P with an 11.6% quarterly increase, marking its strongest quarterly performance in three years. As 2023 concludes, the optimistic sentiment continues, with a positive technical outlook and expanding market breadth anticipated to set the stage for a promising 2024. Forecasts pivot on expectations of forthcoming rate cuts and sustained alleviation in inflation, creating what’s termed a “perfect storm” for stocks in the coming year.

Data by Bloomberg

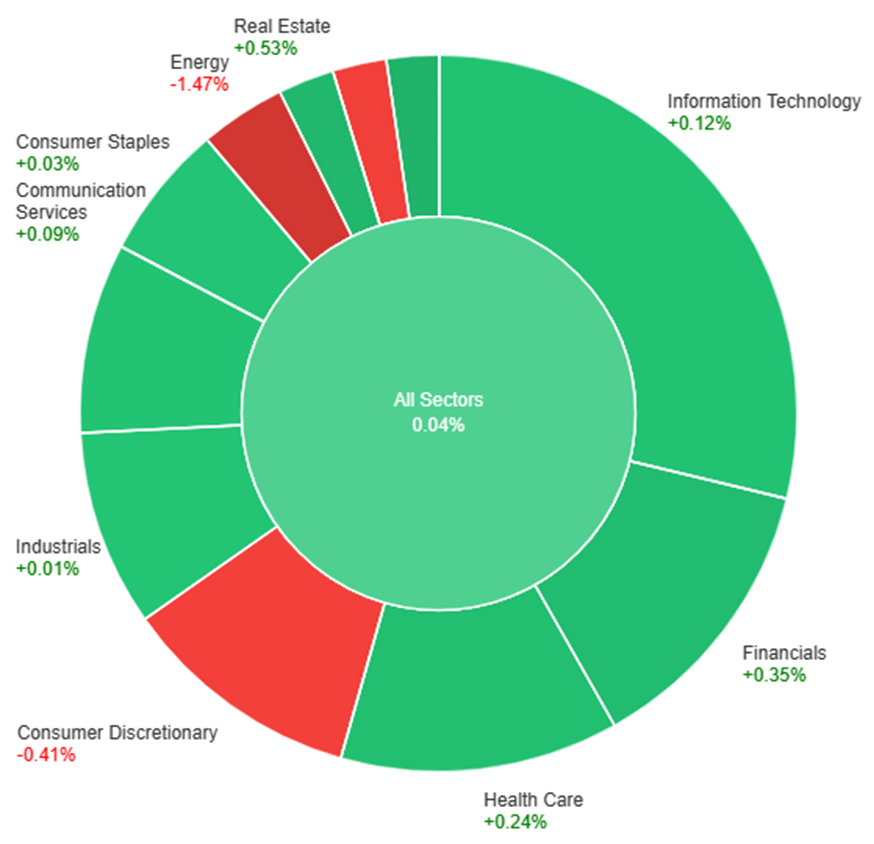

On Thursday, most sectors experienced modest gains, with Utilities leading at +0.70%, followed closely by Real Estate at +0.53% and Financials at +0.35%. Health Care, Information Technology, and Communication Services saw smaller increases ranging from +0.12% to +0.24%. However, Consumer Discretionary and Materials faced declines of -0.41% and -0.46% respectively. Energy witnessed a significant drop of -1.47%, marking the most substantial decrease among all sectors for the day.

Currency Market Updates

In the currency market update, the US Dollar Index (DXY) demonstrated significant volatility, bottoming out at 100.86 before sharply rebounding to 101.25. The Greenback’s resurgence was propelled by a surge in US Treasury yields, reaching 3.85% following a successful auction of the 7-year note. Despite the correction, with higher yields contributing to its recovery, the overall trend for the USD remains downward, albeit with potential for further correction.

EUR/USD faced its steepest decline in two weeks, sliding from a monthly high of 1.1139 to the 1.1055 area. The pair’s movement was influenced by Spain’s impending inflation figures and Eurostat’s scheduled release of Eurozone figures, both expected to provide significant insights into the euro’s trajectory. Similarly, GBP/USD retreated from above 1.2800 to around 1.2700, with the UK’s final economic report for 2023 focusing on Nationwide Housing Prices for December.

USD/JPY experienced notable volatility, plunging to 140.23—the lowest level since July—before recovering to 141.40, supported by rising yields. AUD/USD reached a peak at 0.6871 but failed to maintain momentum, slipping to 0.6835. The Australian Dollar faces immediate support at 0.6825, while a potential upswing could occur if it surpasses 0.6850.

Gold faced a pullback from $2,088 to $2,065 due to the rebounding US Dollar and rising yields. Despite the overarching upward trend, current conditions hint at a potential downside bias ahead of the Asian session for the precious metal. These fluctuations across currency pairs and gold prices reflect the intricate interplay between economic indicators, market sentiments, and geopolitical events driving currency market movements.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Falters Despite US Economic Data; Eyes on Eurozone Inflation

The EUR/USD faced setbacks as it slipped below 1.1100, driven by a surge in US Treasury yields despite mixed American economic reports. The US Dollar remained resilient, largely unaffected by the jobless claims uptick and stagnant pending home sales. Amidst Wall Street’s festive rally, the greenback found strength with a rebound in yields post a 7-year note auction, sidelining the impact of economic data. Attention turns to Spain’s preliminary CPI figures for December, crucial for insight into Eurozone inflation, likely to shape the pair’s trajectory.

On Thursday, the EUR/USD moved lower and reached the middle band of the Bollinger Bands. Currently, the price moving slightly above the middle band, suggesting a potential upward movement. Notably, the Relative Strength Index (RSI) maintains its position at 55, signaling a neutral outlook for this currency pair.

Resistance: 1.1138, 1.1222

Support: 1.1043, 1.0946

XAU/USD (4 Hours)

XAU/USD Continues Surge Amid Dollar Weakness and Investor Optimism

Gold prices are on the rise as the US Dollar faces pressure amidst a buoyant Asian stock market. Investor enthusiasm for anticipated aggressive interest rate cuts by the Fed, coupled with China’s commitment to bolster domestic demand and liquidity injections by the PBOC, fuels risk appetite, edging the Dollar lower. Despite a slight rebound in US Treasury bond yields, Gold maintains its upward momentum, nearing the $2,100 mark in Asian trade. The Dollar Index hovers near five-month lows, while US Treasury bond yields, after bouncing off multi-month lows, stand at 3.81%, up 0.50% on the day. Wednesday’s market return saw Gold hit a record close above $2,070, propelled by a Dollar sell-off post-positive US auctions. Anticipation of Fed rate cuts continues to drive demand for stocks and bonds, influencing Treasury yields. With the focus shifting to mid-tier US Jobless Claims and a seven-year bond auction, Gold traders remain vigilant amid pre-New Year thin liquidity conditions, expecting potential upside boosts.

On Thursday, XAU/USD moved lower and reached the middle band of the Bollinger Bands. Currently, the price moving at the upper band, suggesting a potential upward movement. The Relative Strength Index (RSI) stands at 53, signaling a neutral outlook for this pair.

Resistance: $2,088, $2,103

Support: $2,065, $2,048