On Tuesday, the stock market witnessed modest gains, driven by positive corporate earnings and the investors’ assessment of future Federal Reserve rate cuts. The S&P 500, Nasdaq Composite, and Dow Jones Industrial Average all saw increases, with standout performances from Palantir Technologies and Spotify Technology after reporting strong quarterly revenues. Despite the optimism from earnings, Federal Reserve Chair Jerome Powell’s remarks have cooled expectations for an immediate rate cut, hinting at a possible delay. This cautious optimism was mirrored in the currency market, where the dollar dipped slightly amidst varying signals from Fed officials and global economic updates. Notably, Treasury yields corrected after a recent surge, influencing currency movements and reflecting the market’s nuanced reaction to inflation concerns, Fed policy expectations, and international economic indicators.

Stock Market Updates

On Tuesday, the stock market experienced gains as investors weighed the latest corporate earnings against expectations for future interest rate cuts by the Federal Reserve. The S&P 500 saw a slight increase of 0.23%, closing at 4,954.23, while the Nasdaq Composite edged up 0.07% to 15,609.00. The Dow Jones Industrial Average experienced a more notable rise, adding 141.24 points or 0.37% to finish at 38,521.36. Significant movements were observed in individual stocks, with Palantir Technologies soaring nearly 31% after reporting a revenue beat for the fourth quarter. Similarly, Spotify Technology’s shares climbed almost 4% following its earnings report, which exceeded expectations and showed an increase in Premium subscribers.

Despite the positive momentum from robust earnings among technology giants, recent comments from Federal Reserve Chair Jerome Powell have tempered expectations for an imminent rate cut. Powell suggested that any potential rate reductions might occur later than the market had hoped, pushing back against the anticipation of a March rate cut. This adjustment in expectations comes as the market sees narrow leadership, raising concerns about the sustainability of the current rally without broader market participation. As the earnings season reaches its midpoint, notable companies such as Amgen, Chipotle Mexican Grill, and Ford are poised to release their financial results after the market closes, potentially influencing future market movements.

Data by Bloomberg

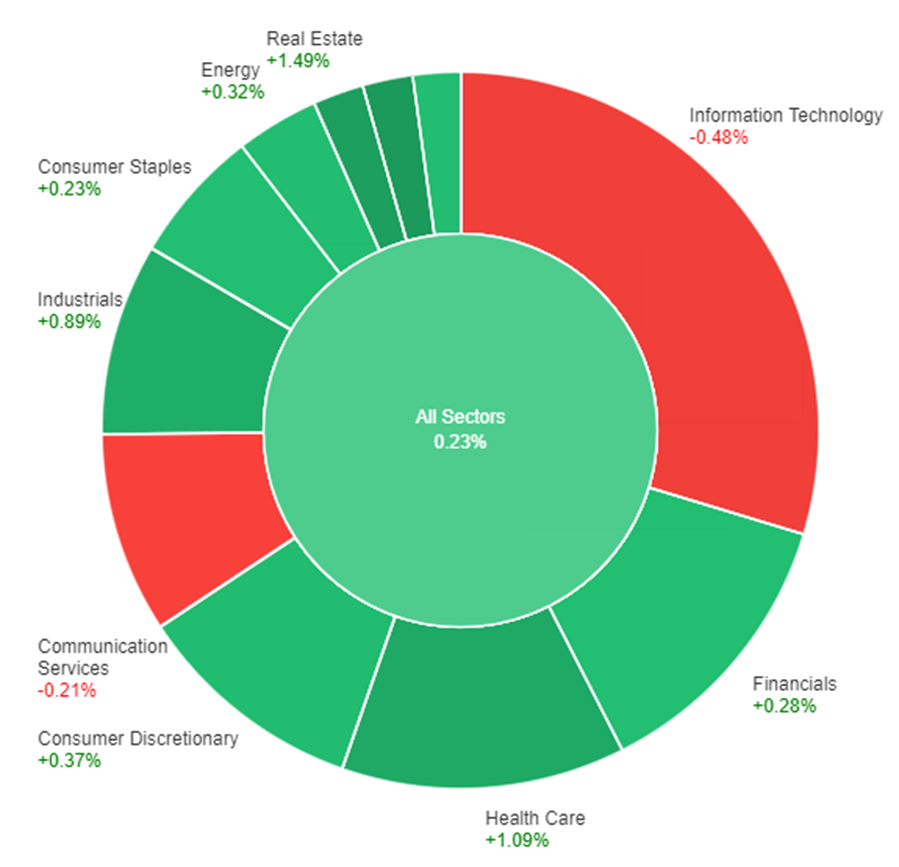

On Tuesday, the overall market saw a modest increase, with all sectors combined going up by 0.23%. The Materials sector led the gains with a notable rise of 1.71%, closely followed by Real Estate and Health Care, which went up by 1.49% and 1.09%, respectively. Industrials also saw a healthy increase, up by 0.89%. Other sectors such as Consumer Discretionary, Energy, Utilities, Financials, and Consumer Staples saw more modest increases, ranging from 0.37% to 0.23%. In contrast, Communication Services and Information Technology experienced declines, down by 0.21% and 0.48% respectively, indicating a mixed performance across different market areas.

Currency Market Updates

In the recent currency market updates, the dollar experienced a slight decline, losing 0.25% against a basket of currencies. It marked a correction following its sharp gains fueled by inflationary pressures evident in U.S. jobs and ISM services reports. This movement in the dollar index was accompanied by a retreat in Treasury yields, which had previously surged but encountered resistance, leading to a correction. The EUR/USD pair managed to recover from early losses, finding support at December’s lows, as the correction in Treasury yields eased the upward pressure on the dollar. This shift comes amid a backdrop of no significant U.S. economic releases, except for the New York Fed’s report on Q4 Household Debt and Credit, which highlighted increasing credit stress among the less creditworthy, even as overall delinquency rates remained lower than pre-pandemic levels.

Further influencing the currency markets, Treasury Secretary Janet Yellen expressed manageable concerns over commercial real estate, while Federal Reserve Bank of Cleveland President Loretta Mester indicated a possibility of gradual rate cuts if inflation continues to decline. The EUR/USD pair also received a boost from a significant rise in German industrial orders, notably influenced by a surge in aircraft orders, despite the broader data suggesting a more nuanced picture. Other currencies like the Sterling saw gains against the dollar, buoyed by improved UK PMI figures and a more risk-friendly market atmosphere, partly due to positive movements in Chinese equities. Meanwhile, the USD/JPY pair corrected after a rapid rise, influenced by Treasury yield adjustments and shifting expectations regarding Fed rate cuts and potential monetary policy adjustments by the Bank of Japan, highlighting the global interconnectedness of currency movements and monetary policies.

Picks of the Day Analysis

EUR/USD (4 Hours)

EUR/USD Outlook Amidst US Dollar Fluctuations and Central Bank Decisions

As the US Dollar’s demand declines, the EUR/USD pair may see fluctuations influenced by recent central bank decisions and US economic data. With the Reserve Bank of Australia maintaining a cautious stance and the possibility of delayed rate cuts by the Federal Reserve, investor sentiment shifts, impacting bond yields and the USD’s appeal. Additionally, remarks from Federal Reserve officials, including Loretta Mester, could further influence market dynamics and the EUR/USD trajectory, amidst a lack of significant macroeconomic releases.

On Tuesday, the EUR/USD moved flat between the lower and middle bands of the Bollinger Bands. Currently, the price is moving just below the middle band with wider bands, suggesting a potential upward movement to reach the middle band. Notably, the Relative Strength Index (RSI) maintains its position at 42, signaling a neutral but bearish outlook for this currency pair.

Resistance: 1.0817, 1.0880

Support: 1.0724, 1.0662

XAU/USD (4 Hours)

XAU/USD Recovers as US Dollar Demand Weakens Amid Central Bank Caution

Spot Gold (XAU/USD) experienced a recovery on Monday, trading near an intraday high of $2,038.17, as demand for the US Dollar waned following global central bankers’ hints at maintaining current monetary policies, contrary to earlier investor expectations for tighter monetary conditions. This shift came after the Reserve Bank of Australia signaled a possible continuation of rate hikes if necessary, aligning with cautious sentiments from other central banks. Despite strong US macroeconomic data supporting the Dollar and boosting government bond yields, a subsequent rally in bonds and a retreat in yields by Tuesday signaled a market repositioning that favored Gold. This adjustment occurs in a week’s light on macroeconomic announcements but with anticipated comments from Federal Reserve officials, including Loretta Mester.

On Tuesday, XAU/USD moved higher and was able to reach the middle band of the Bollinger Bands. Currently, the price is moving slightly below the middle band, suggesting a potential upward movement to reach the upper band. The Relative Strength Index (RSI) stands at 51, signaling a neutral outlook for this pair.

Resistance: $2,043, $2,062

Support: $2,031, $2,016

Economic Data

| Currency | Data | Time (GMT + 8) | Forecast |

|---|---|---|---|

| NZD | Employment Change q/q | 05:45 | 0.4% (Actual) |

| NZD | Unemployment Rate | 05:45 | 4.0% (Actual) |