Market Focus

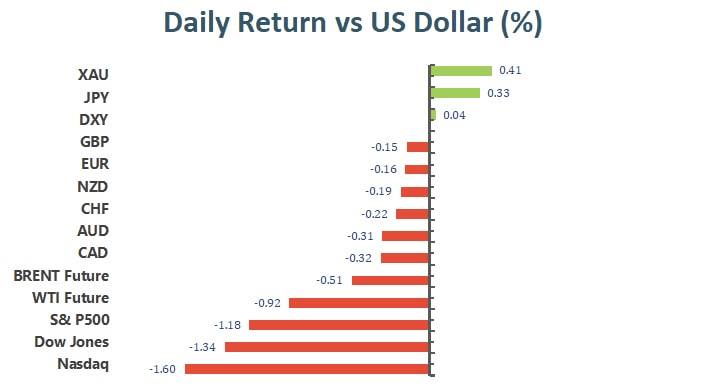

US equities underwent their worst back-to-back collapse since October 2020 as Fed Chair Jerome Powell reiterated his pivot to inflation vigilance and the omicron variant continued to spread, with the U.S. confirming its first case on Wednesday. In a very volatile session, the S&P 500 erased gains after climbing almost 2% in the first half of the Wall Street hours. Dow Jones slid 1.34% to 34022.07, and Nasdaq Composite plummeted 1.83% to 15,254.05. Airlines, cruise operators and hotels also slumped. Investors flocked to the relative safety of Treasuries, with the yield on the 10-year note down to 1.404%.

On the market front, professional traders bailing from stocks as anxiety over the omicron variant and monetary policy roil markets. Hedge funds have gone risk-off in a major way just as the S&P 500 endured a massive two-day pullback. Net leverage, a measure of industry risk appetite that takes into account long versus short positions, fell to a one-year low this week, according to data compiled by Goldman Sachs’ prime brokerage.

The move is in contrast to retail traders, who renewed their manic dip buying after Tuesday’s rout, pushing stocks higher by almost 2% earlier in Wednesday’s session. Then Jerome Powell reinforced his message that the Federal Reserve would keep inflation in check and officials confirmed the first case of the omicron variant in the U.S. That sparked an afternoon selloff that left the S&P 500 with its biggest reversal since April 2020.

Few corners of the market were spared, as small caps gave up a 2.5% surge to end lower by more than 2%. Bitcoin dropped below $57,000, oil hit $65 a barrel and Treasuries rallied on demand for safety. The S&P 500 is now down 3.1% in two sessions and more than 4% from its last record on Nov. 18.

Main Pairs Movement:

Unlike the dismal stock markets, fears seem to cool down a bit for forex on Wednesday, resulting in major pairs holding into familiar levels. The greenback ended the day mixed, firmer against commodity-linked peers but down against other safe-haven currencies.

The cautious optimism came from the World Health Organization, as it said that current vaccines could still offer protection against the new Omicron coronavirus variant, preventing severe illness. Also, the WHO reported that so far, the new strain seems to be causing milder symptoms and illness. However, risk of Fed’s earlier taper remains, as Chief Powell said they need to remove the word “transitory” while describing the U.S. inflation issue.

The EUR/USD pair trades around 1.1320, while GBP/USD stands at 1.3280, both at risk of falling further. The AUD/USD pair trades at around 0.7110, while USD/CAD is pressuring daily highs in the 1.2830 price zone. USD/JPY and USD/CHF posted mild gains, up 0.15% and 0.21% respectively.

Gold remains under pressure, currently trading at $1,780 a troy ounce. Crude oil prices edged lower, with WTI now at around $65.75 a barrel, and Brent at $68.50.

Technical Analysis:

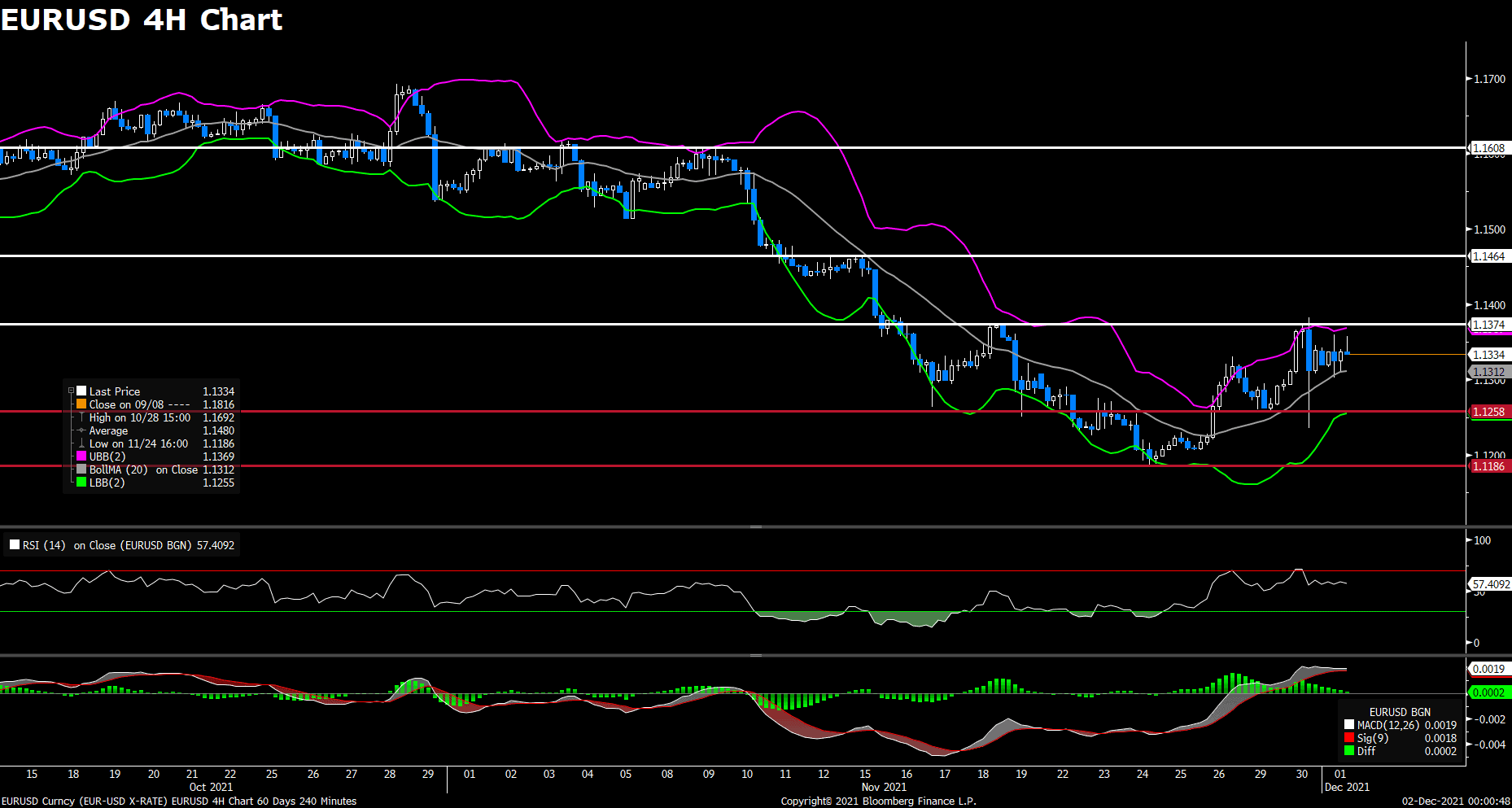

After dropping to a weekly low around 1.124 area, the pair EUR/USD saw some buying and rebounded slightly on Wednesday. The pair was flirting with 1.133 area most of the day, now sitting in negative territory and holding above 1.132 level. The renewed strength witnessed in the greenback weighed on EUR/USD, which currently losing 0.06% on a daily basis. Stronger US dollar across the board today dragged the pair lower, as the DXY index rose 0.02% amid upbeat market sentiment. The US ADP Employment Change for November showed that private payrolls rose by 534K, which is more than market’s expectations. In Europe, concerns about the new omicron variant and the likeliness of lockdown in many countries may dampen the near-term outlook for the European currency and cap the upside for the EUR/USD pair.

For technical aspect, RSI indicator 59 figures as of writing, suggesting that the upside appears more favored as the RSI still above the midline. As for the Bollinger Bands, the price is consolidating between the moving average and upper band, therefore the bullish traction could persist for a while. In conclusion, we think market will be slightly bullish as the pair is heading to re-test the 1.1374 resistance. A break above that level would target 1.1464.

Resistance: 1.1374, 1.1464, 1.1608

Support: 1.1258, 1.1186

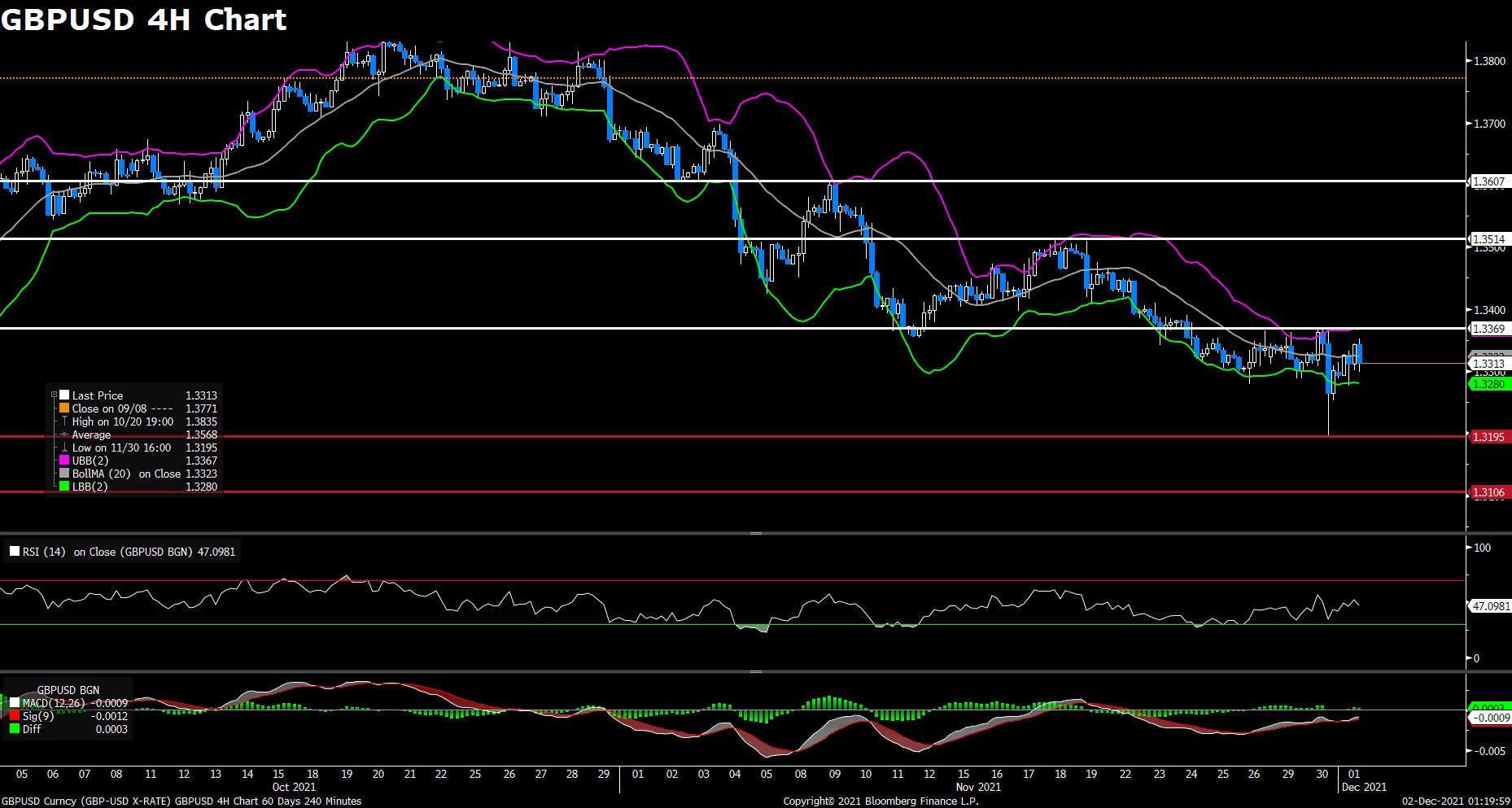

The pair GBP/USD edged higher on Wednesday, ending its previous slide to the lowest level since December 2020. The pair stayed steady to the north of the 1.330 level for most of the day and touched a daily top in American session. At the time of writing, the cable stays in positive territory with a 0.08% gain for the day. The recovery in sentiment for global equity and commodity markets acted as a tailwind for the British pound, which is one of the risk-sensitive currencies. On the economic data side, the UK Manufacturing PMI came at 58.1 for November, which is slightly lower than estimates but did little impact to the cable. Meanwhile during the testimony earlier in the session, Fed Chair Jerome Powell also reiterates that it is appropriate to consider a faster QE taper before the House Financial Services Committee.

For technical aspect, RSI indicator 46 figures as of writing, suggesting that sellers remain in control of the pair’s action in the near term. As for the Bollinger Bands, the price is sitting between the moving average and lower band, therefore the downside momentum should be stronger. In conclusion, we think market will be bearish as long as the 1.3369 resistance line holds. The hawkish tone from Powell could limit any further gains for the cable.

Resistance: 1.3369, 1.3514, 1.3607

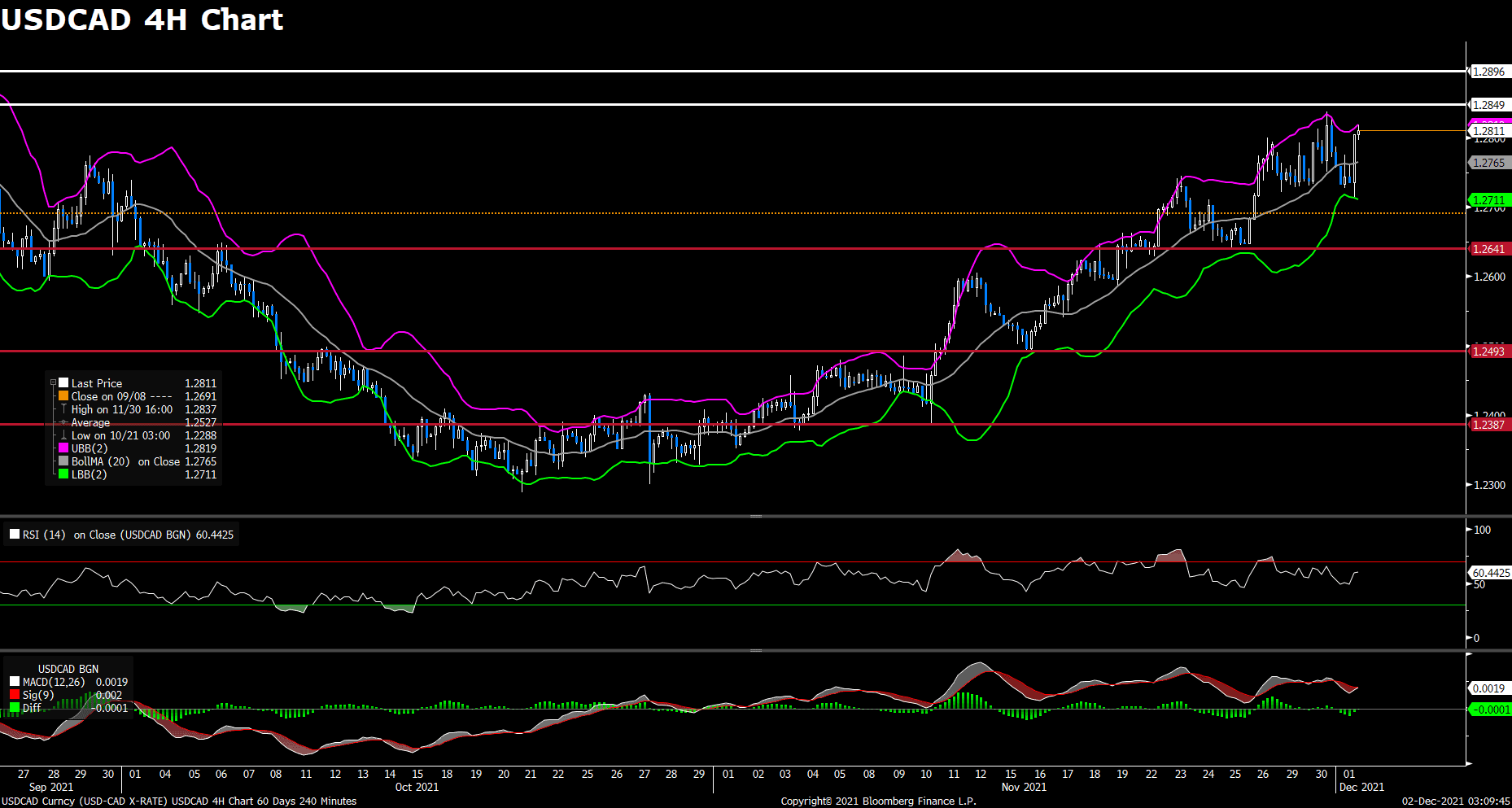

After previous day’s rally to a two-month high near 1.284 level, the pair USD/CAD preserved its upside traction and edged higher on Wednesday. The pair was surrounded by bearish momentum during Asian session, but then rebounded back above 1.278 area amid renewed US dollar strength. USD/CAD now continues to climb higher, currently rising 0.26% on a daily basis. Rising expectations for a Fed rate hike continue to lend support to the greenback and USD/CAD, as Powell said that Fed will have a discussion about accelerating taper by a few months at their next meeting. On top of that, the pullback in crude oil prices from earlier session peaks weighed on the commodity-linked loonie and pushed USD/CAD higher, as WTI oil dropping 1.43% for the day.

For technical aspect, RSI indicator 60 figures as of writing, suggesting that the upside appears more favored as the RSI still above the midline. Looking at the MACD indicator, a golden cross is forming on the histogram, which indicated upward trend for the pair. As for the Bollinger Bands, the price is from the moving average to upper band, therefore the upside traction could persist. In conclusion, we think market will be bullish as the pair is eyeing a test of the 1.2849 resistance.

Resistance: 1.2849, 1.2896

Support: 1.2641, 1.2493, 1.2387

Economic Data

|

Currency |

Data |

Time (GMT + 8) |

Forecast |

||||

|

AUD |

Retail Sales (MoM) |

08:30 |

4.9% |

||||

|

USD |

Initial Jobless Claims |

21:30 |

240K |

||||