Daily Market Analysis

Market Focus

US equities gained traction on Tuesday, the three big indices each rallied nearly 2% amid corporate earnings seasons. Meanwhile, the Reddit frenzy has been cooled off, GameStop Corp. and AMC Entertainment Inc. tanked 56% and 40% respectively. The GameStop rout wiped out $27 billion market value as Redditors leave the party, however, the battle between retail investors and hedge funds may not be over.

The Senate will begin a process that will allow Democrats pass President Joe Biden’s $1.9 trillion proposal without Republican votes, Majority Leader Chuck Schumer said. Although the push to deliver relief package is urgently needed, but a single party vote could somewhat contradict President Biden’s calls for unity during his inauguration.

RBA kept interest rate unchanged at 0.1% on Tuesday, here are the key takeaways from its monetary statement:

Market Wrap

Main Pairs Movement

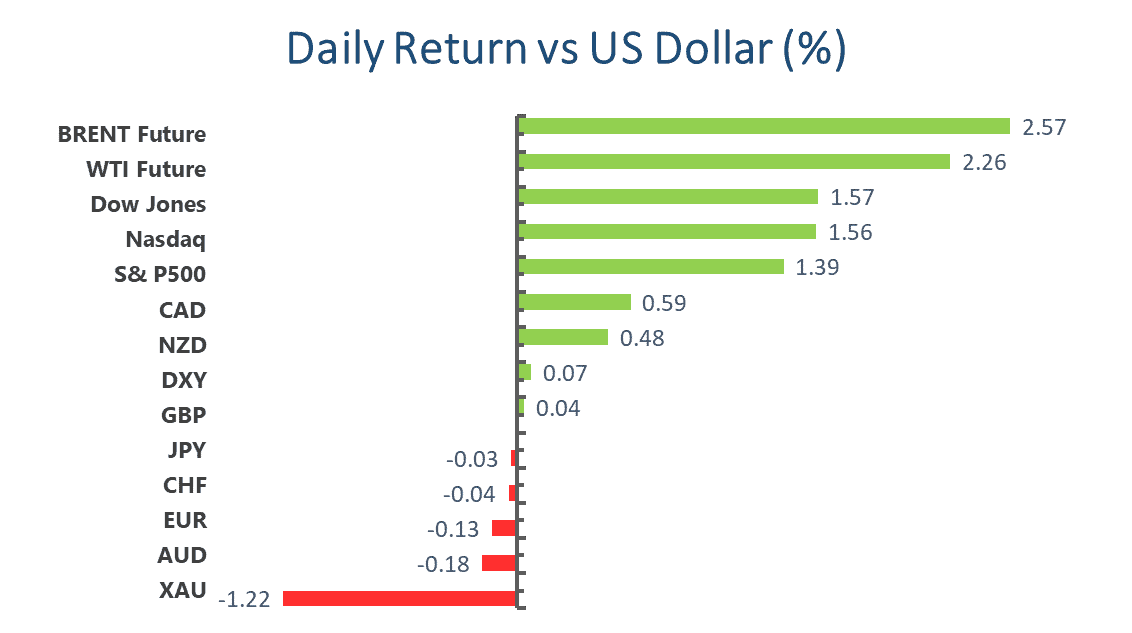

The US greenback recovered amid rising 10-year US treasury yield reclaim 1.1% on Tuesday. Safe-haven currencies like the Japanese Yen and Swiss Franc were on the defensive as investors are reviving carry trades, both down 0.1% against the dollar.

Gold is falling in sync with significant pullback in silver markets, gold dropped 1.21%. After a sudden surge in retail investor demand for the silver metal subsides, silver price ramped up nearly 19%, refreshing 8 years record high. CME immediately followed to hike margin requirement for silver futures, a move that is said to take some of the froth out of the market. Soon, Redditors realized they are picking the wrong bully, as a result silver price dumped 8% on Tuesday.

Euro-dollar declined 0.2%, to the lowest level since Dec. 1, 2020. The shared currency lagged behind as the EU vaccination program slowly takes place across regions. On the data front, fourth-quarter GDP from the EU Zone declined 5.1% on a year-to-year basis, missing expectation of -4.3%, putting further pressure on the Euro.

The Cable was essentially unfazed at 1.3658. Scotland has extended its current lockdown into early March. The pandemic situation continues to ease in the UK with its government speeding up vaccine immunization. So far, the UK has administered nearly 10 million doses.

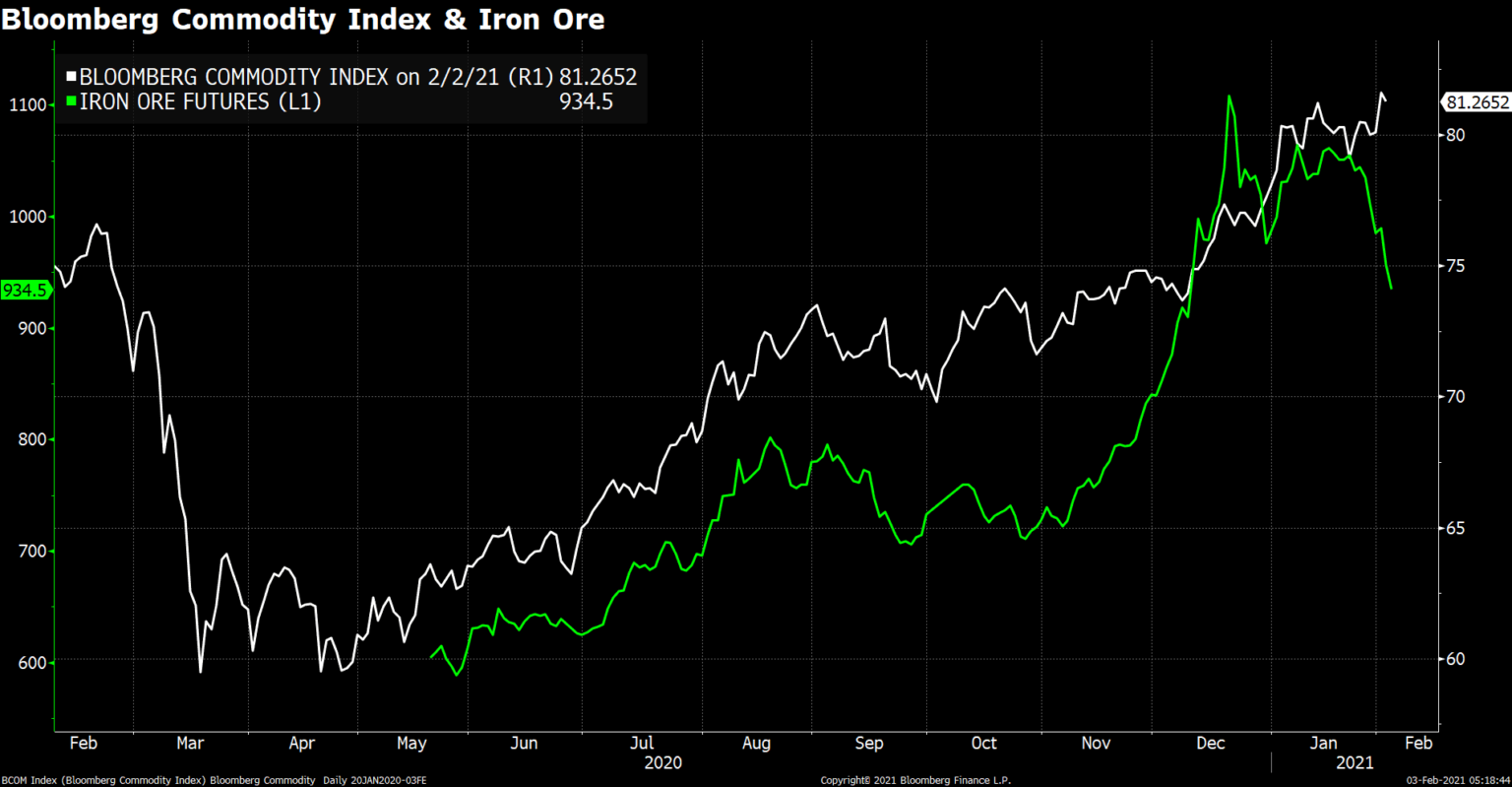

Kiwi outperformed its peer Aussie, AUDNZD slipped 0.33%. The Aussie failed to bounce upon RBA’s optimism towards its economic recovery. Falling iron ore prices are dragging down the commodity linked currency, market consensus on reflation trades seems to take a pause from here.

Technical Analysis:

EURUSD (Daily Chart)

Euro-dollar breached a critical support line at 1.206. This level has successfully defended seller’s attack in the last two months, but its strength looks faint this time. We cannot rule out the possibility of a false breakout, Tuesday’s session settled with a long lower and upper wick, which always indicates tentative trading. If the downward breakout is proven to be valid, then the bears will eye for 1.193 support. However, the longer-term ascending trend line is expected to persist as the general dollar weakness theme remains intact throughout 2021. On the upside, it would take a while for the bulls to build up power to march toward 1.233 resistance.

Resistance: 1.206, 1.2333

Support: 1.193, 1.163

USDJPY (Daily Chart)

USDJPY has overcame the long descending trend line that kept price subdued since last March. Bidders cheered the bullish reversal and ramped up 1.5% in the past 5 sessions. The bulls are now eyeing for the 38.2% Fibonacci retracement of 105.4, but given its previous strong rebound, upward momentum is exhausting prior reaching 105.4. Nonetheless, we expect price to at least touch this level within the near term before staging for a retreat. On the south, DMA100 could be supportive if the bulls lose steam. MACD on the daily chart is indicating a sustainable bullish trend.

Resistance: 105.42, 106.72

Support: 104.4, 103.84

XAUUSD (Daily Chart)

Gold is under pressure on Tuesday, slipping from $1865 to $1838, refreshing two-week lows. Despite breaking the ascending trendline from below, the precious metal is still able to find acceptance from $1839-$1822 support band. Weak dollar narrative has been changed recently attributed to rising treasury yield, it would be interesting to see how bidders will react to Gold’s declining price this time around. If they give up the defense line at $1822, then the bears will bring price down to $1765, last seen in November 2020. Conversely, we expect some rangebound trading between $1874 and $1838 if downward momentum looks unconvincing. MACD on the daily chart provide little to no sign of trading direction.

Resistance: 1874, 1930

Support: 1838, 1823, 1765

Economic Data

|

Currency |

Data |

Time (TP) |

Forecast |

||||

|

NZD |

Employment Change (QoQ) (Q4) |

05:45 |

-.08% |

||||

|

EUR |

ECB Monetary Policy Statement |

16:00 |

N/A |

||||

|

GBP |

Composite PMI (Jan) |

17:30 |

40.6 |

||||

|

GBP |

Services PMI (Jan) |

17:30 |

38.8 |

||||

|

EUR |

CPI (YoY) (Jan) |

18:00 |

0.5% |

||||

|

USD |

ADP Nonfarm Employment Change (Jan) |

21:15 |

49K |

||||

|

USD |

ISM Non-Manufacturing PMI (Jan) |

23:00 |

56.8 |

||||

|

OIL |

Crude Oil Inventories |

23:30 |

0.446M |

||||